(first published on bankinnovation.net)

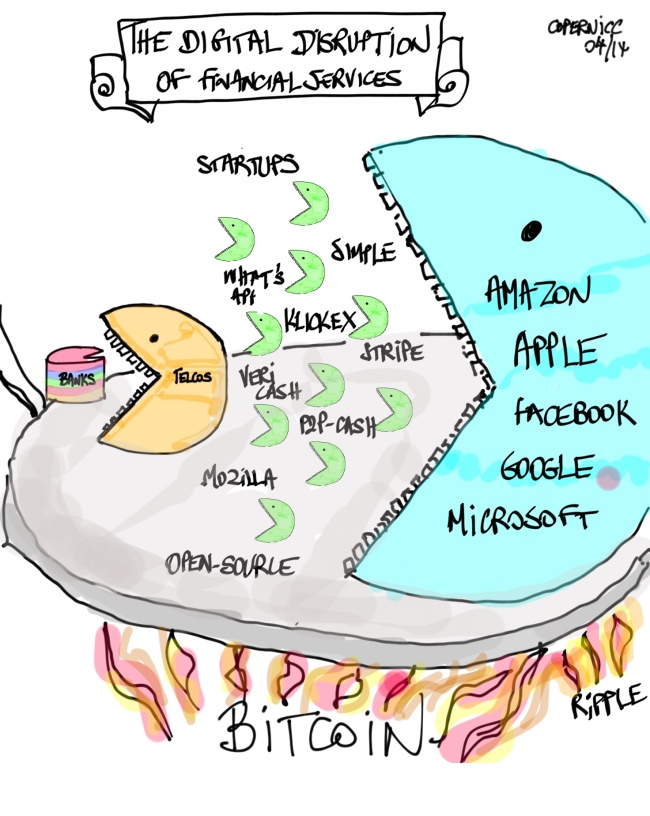

A new wave of technological change is right beyond the next hill, really in the next couple of years. Its most visible symptom is the hyper-connectivity to the Internet, which fuels the evolution of:

- bitcoin-inspired distributed systems,

- open APIs (application programming interface) as a new way to consume business services on the internet,

- crowd-sourced identity schemes, and

- open source hardware and applications.

How can the traditional industry players prepare for such changes? How can we leverage these changes to make low cost, secure and reliable financial services available for everyone on the planet?

Imagine yourself being an electro-mechanical engineer back in the late 1940s. This was a period of vacuum tube electronics, and the appliances using this technology were widely used from the household to the heavy industry. it was a time where the technology was mastered. This vacuum tube “castle”, a safe and predictable technology, had gone through many cycles of improvement since its inception at the turn of the century. On the other hand, it was clear that the technology was reaching its limits in many applications that required different characteristics of portability and power consumption. The ”sandbox” experiment that would revolutionize the whole field of electronics had been carried out in Bell Laboratories and was unveiled in 1948 – the transistor. We know what happened next. Of course, with the benefit of hindsight, it is clear that the transistor would wipe away the old technology. But I’m sure that it was not so obvious to electro- mechanical engineers a few short years before 1948.

Is the traditional consumer financial system, based on bank accounts, in the same situation today? Are we in the age of “vacuum tube financial services”, with the transistor right beyond the next hill? I can see solid, substantiated indicators that make me think we are indeed facing such change. I’ve observed these indicators over the last year, and they appeared even more clearly to me in the new job I took in the Financial Services for the Poor and the Bill & Melinda Gates Foundation.

Let’s first consider a number of changes that can be observed on the way people perceive and use financial services. Technology has so far made it possible to accelerate the pace and volume of transactions, but it has not transformed the relationship between the industry and its customers in the same way as it has in, say, publishing (from books to e-books), movies (from DVD to mp4), or popular music (from CD to mp3 to streaming).

Changes in the use of financial services

The first change comes from the next generation of consumers. The Internet is now more than 20 years old, which means that anyone under 40 has never known a social or working life without it. As a result, younger consumers come to the market with different expectations from service providers. Instead of technology being used to hold them captive, they expect service providers to use technology to empower them to determine not only how services will be provided, but what services will be provided. Just consider how today people prefer to use their Facebook name to identify themselves to new sites on the Internet, showing how the power gradually moves into their hands.

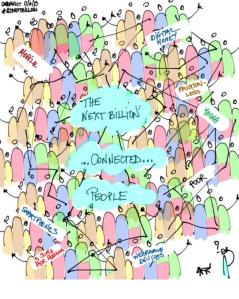

The second change comes from the estimated 2+ billion people who today have no access to any financial service, and resort to cash for all transactions. The traditional banking system has all but ignored them, as they don’t fit the established business model of the

banks. The problem the banks have in serving these people is not so much in terms of lack of revenues, but it is mostly of having access to them, as many of the poor people are far away in rural areas without traditional banking coverage (branches and ATMs). The other problem is getting to know them, as the traditional ways of identifying people (social security, street addresses, etc.) are mostly not available to these people. On the other hand, a large majority of them have a mobile phone, a very powerful instrument of communication but also inclusion. This explains why the telecommunication companies are increasingly seen as instrumental in making financial services available to the unbanked.

The last change comes in the way we access and consume financial services. Perhaps this change is most perceptible with the advent of the tablets. As an European consumer until recently, I was used in dealing with my few banks through heavily secured web sites – all different, all using specific and incompatible hardware security tokens. The smart phones and especially tablets have simplified this considerably, but most of us are still facing a different app for each service provider, while what we really want is to have a seamless and integrated view of our financial assets. One identity, one user interface for all service providers.

The above changes – really new, fundamental requirements – are driving the pace of technological innovation. I’ve observed four of these innovations, and I will illustrate them mentioning companies that have products available today or in a matter of months (I’m mentioning these particular companies because I had the opportunity to study them firsthand. I’m not related in any way with any of the mentioned companies).

Four financial innovations

The first innovation is bitcoin. I think of “bitcoin” (lower case) as a technology, as opposed to “Bitcoin” (upper case) the crypto-currency. Bitcoin, the currency, has been through several boom and bust cycles, served (or not so well served) by the Bitcoin exchanges, some of which have recently succumbed to concerted hacking attacks. It is possible that the new wave of exchanges, should they be better equipped for operational excellence and “five-nines” availability, will propel Bitcoin as a widely used currency.

In my mind though, the true innovation is not about the currency but is about the bitcoin blockchain, a single database massively distributed and replicated, without any central coordinating point. Ripple, a company based in San Francisco, uses this idea to propose what they describe as a low cost, worldwide, multi-currency payment mechanism they say is faster, more secure and simpler to use than any banking based alternative. The system is based on secure wallets managed by the users themselves, and a distributed ledger inspired by the bitcoin blockchain. From the customer perspective, the operative word is low cost – the system is open, and as there is no central authority necessary, there are therefore no fees associated to intermediaries.

The second innovation is the business API (application programming interface). The API has been used since many years by software developers to assemble program components within an application. The new use of APIs is to make business functions available as components on the Internet (think how Google Maps can be integrated into other applications and web sites).

The promise of APIs is to grow volumes from existing customers, and attract new customers without friction. Adopting APIs does require though a leap of faith in the traditional marketing doctrine – indeed, rather than trying to “capture” customers into a bespoke system, the API actually fosters opening the systems to be freely assembled by the consumers in the way they desire. As such, making the move to business APIs is a tricky decision to make for many businesses, especially the banks.

Stripe, a company based in San Francisco, proposes to enable a business to process electronic payments simply by integrating Stripe’s APIs (and supporting processes). Apigee, another company in the Silicon Valley, propose to “API-ise” a business and make their services available in new ways on the Internet. So does the Open Bank Project, a German startup, who focuses specifically on banks.

The third innovation is a crowd-sourced, social media based, identity system.

In the current financial system, regulation impose that banks and other players conduct “Know Your Customer” (KYC) activities, with the goal of confirming the identity of people that open accounts and conduct transactions. In many occasions though, KYC proves to be very cumbersome because it implies manual checks of various documents. I can vouch, as a newcomer in the USA, that opening an account can be very tricky if you don’t have a document proving that you live at a particular address (but living at a particular address does require usually to have a bank account, as you need to pay rent or mortgage – you can see how tricky this can be). Viewed from the perspective of onboarding billions of people, it is clear that a different solution is needed. OIX (the open identity exchange) and the Respect Network have come up with a crowd-sourced reputation system on the internet, where people on the internet can trust each other based on their digital reputation. I’ve written previously about how this works in some detail. I’ll use another example to illustrate – think about your persona on Facebook. Your timeline, friends, likes describe a digital identity that can be trusted over time, as more and more interactions accumulate. In other words, another way to look at Facebook (or LinkedIn and other major social networks) is as a trusted identity system. Now, Facebook connects in excess of one billion people, many of them unbanked, which could be a great opportunity to hook these people to financial services without friction. For example, Fidor, a financial service provider in Germany, allows you to open an account with only your Facebook profile. Of course, they will only let you start with a reduced service, and will provide additional financial services as they know more about you. This “tiered KYC” system reduces friction and is a powerful instrument of inclusion.

The fourth innovation is about using the open source movement in the context of financial services. Mozilla is a good example of how it is possible to create a community of millions of developers working on the same project, based on meritocracy. Outside of the well known Android and Firefox projects, Mozilla has recently shown that open source can be applied to hardware and not only software – the $25 Mozilla smart phone promises to be another instrument of inclusion to the internet, and also of course financial services in the long run. I’ve written about how the open source concept is being applying to core financial systems. Allevo, a Romanian software company, has recently put in the open source domain a core banking transaction-processing software. OpenGamma is a UK startup that uses open source to provide a risk analytics platform, one of the “crown jewels” of banking, to financial institutions.

How can we then envision a financial system that rides the wave of change, and leverages the technological innovations we have reviewed above?

I think about this from the perspective of the billions of unbanked, and the next billion of hyper-connected individuals that will be the customers of tomorrow. The financial system will need to be a platform that federates existing players (such as banks) and new players (such as telecommunication companies and other information technology companies) that will –

- Be accessible safely and reliably from connected devices, from feature phones to smart phones to other specialized (wearable?) devices.

- Enable new customers to be connected seamlessly, using a crowd- sourced and flexible “know your customer” system

- Enable customers to own their accounts, and operate them themselves or choose freely who to contract to operate it for them

- Be based on open APIs so new service providers (payments, insurances, loans, etc.) can be connected and discovered easily.

- Be based on open APIs so customers can freely choose how to combine the services on the platform in new ways that suit them

In addition, the platform should be available in open source – so that it can be permanently refined and built upon, as a common asset of the humanity.

Deploying such a platform and fostering its deployment in countries and – why not – globally: that is the ambition of the Financial Services for the Poor initiative of the Bill & Melinda Gates Foundation. In this endeavor, the technology I describe will be necessary, but not sufficient. As I have written previously, another important aspect of the work will be to put all the key stakeholders around the table – banks, central banks, telcos, startups. All hands will be needed on deck to deploy the technology to work openly, safely and reliably.